American Butterfly (Jan 2012 to Mid 2013)

1. The Theory of Every Business — (Jan to Sep 2012)

2. Spiritually Inspired Software — (Quantum Economics) — Oct 2012

3. The Network on a String — (Superstring Economics) — Nov 2012 to Jan 2013

4. The Butterfly — Utterly Incomplete and Very Rough — Jan to Apr 2013

MARS Resort 1 — The Return of ŔÉŚ — For Elon Musk — Oct 2017

Ripple Effects and Elephants for Paul G Allen — Jan 2018

The Villa Secrets Secret — 2014 to 2017

Complete Book — PDF

Online Version — Summary

Chapter 1.1.6 — S-Web — Our Solution

Chapter 2. The S-World Villa Secrets Network

Chapter 3. Mandates - Mandates - Mandates and Prestige Marketing

Chapter 4. The CDS — Content Distribution System

Chapter 6. The CRM Nudge AI™

Chapter 7. The TFS™ – Total Financial System

Chapter 8. Villa Secrets Property Managers and Owners

Chapter 9. S-World CRM-CC ™- The Company Controller

Chapter 10. S-World UCS™ Hawthorne

Angel Theory — Foundational Ideas — 2016

A New Theory of Everything for Michael Green — March 2016

M-System 3 — The Susskind Boost — March 2016

M-Systems 4 — The Peet Tent — March 2016 to 2017

M-Systems 14 — Angel Cities — May 2016

M-Systems 1 to 14 — Aug 1st 2016

M-Systems 1 to 8 — Aug 2016

S-World Angel Theory — The Sienna Foundation — Inspiration — Sep 2016

S-World — Experience Africa — Oct 2016

S-World dot biz and American Butterfly — Nov 2016

M-System 14 — Angel Cities and Special Projects — Nov 24th 2016

From M-Theory to M-Systems — Dec 2016

Angel Theory — Book — 2017 to 2021

M-Systems & Angel City 5 — The Movie — Aug 1st 2017

The E-TOE — The Economic Theory of Everything — Nov 2017

A Love Story and Theory of Everything — Nov 24th 2017

Ripple Effects and Elephants for Paul G Allen — Jan 2018

Angel Theory — The Economic Theory of Everything — Books — Feb 2018

Angel Theory — Paradigm Shift — April 2018

Supereconomics Book 2 — Š-ŔÉŚ™ Financial Engineering — 2012 to Feb 2020

Supereconomics Book 3 — 64 Reasons Why — Summary — 2019 to Feb 2020

Supereconomics Book 2 — S-RES and The City — May 2021

M-Systems — A More Creative Capitalism — 2016 to 2018

Inspiration — Bill Gates Harvard Commencement Speech — 2007

Ripple Effects and Elephants for Paul G Allen — Jan 2018

UCS™ History 1 - POP Super Coupling — The Green Symmetry — Feb 2018

A More Creative Capitalism — Summary — Apr 2018

A More Create Capitalism — A Good Model — Theoretical Physics — June 2018

A More Create Capitalism — Book — Apr to Oct 2018

S-World UCS™ Hawthorne — For Richard Thaler & David Hoffeld — June 2018

S-World BES™ — Behavioural Economic Systems — Malawi FC — July 2018

The Rodrik Conjecture with Ed Witten & Stephen Hawking — Aug 2018 (& July 2021)

A More Creative Capitalism — Chapter 4. The ŔÉŚ Equation — Oct 2018

Growth Theory versus Climate Change (The Elephant in the Room) — Nov 24 2018

The Momenent of Lift — A Message for Melinda French Gates — May 18 2021

American Butterfly 2012 — My First Economics Book in Four Parts — 2012 to 2013

Book 1 — The Theory of Every Business — Apr to Sep 2012

Book 1 — Ch 7 — T5. S-World VSN — S-World — Siennas World — Aug 2012

Book 1 — Ch 8 — T6. S-World UCS — In Game — (S-RES 1) — Sep 2012

Book 2 — Spiritually Inspired Software — Oct to Nov 2012

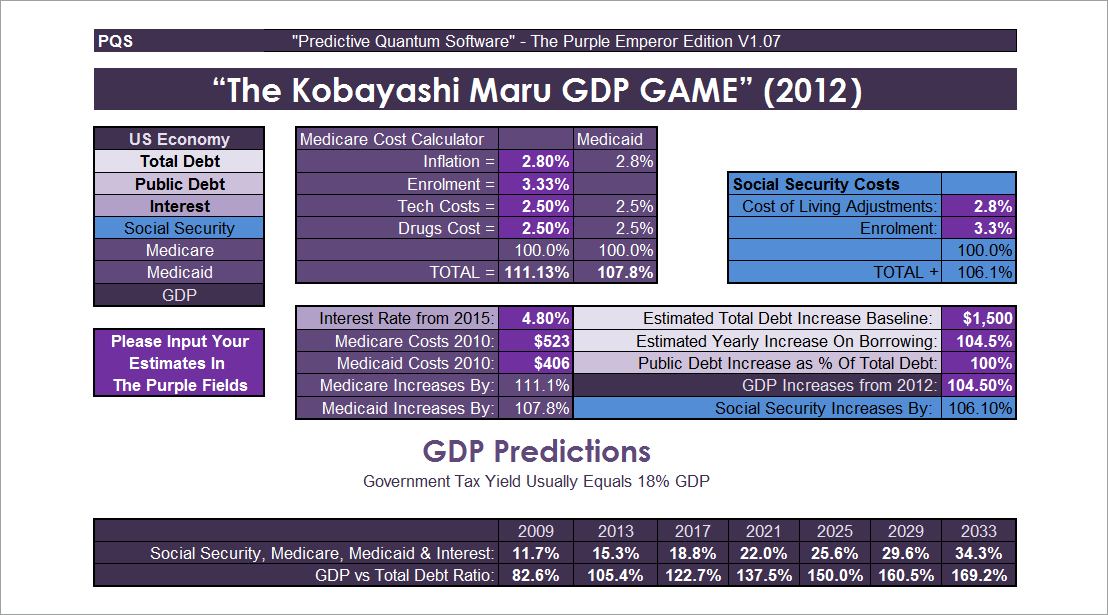

Book 2 — Ch 1 — The Entangled Butterfly (The PQS) — Oct 2012

Book 2 — Ch 1g — Predictive Quantum Software — Oct 2012

Book 2 — Ch 2 — To Infinity and Back Again — Nov 2012

Book 2 — Ch 3 — Strings of Life — (S-RES 2) — Oct 2012

Book 3 — The Network On A String — Dec 2012

Book 3 — Ch 3 — Quantum Spin & the RES ⇔ Equation — (S-RES 3) — Dec 2012

Book 4 — A SWOT Analysis and The Butterfly — Jan to Apr 2013

Angel Theory — 2015 to 2017

AngelTheory.org

M-System 3. The Susskind Boost — Mar to May 2016

M-System 14 — Plus the Right Side Bar Menu — 25th May 2016

S-World Angel Theory — Inspiration — The Sienna Foundation — 9 Sep 2016

Dr Amanda Peet — From M-Theory to M-Systems — Dec 2016 to Jan 2017

An Introduction to M-Systems — 11 Apr 2017

★ M-Systems and Angel City 5 — The Movie — 1 Aug 2017

★ The E-TOE — An Economic Theory of Everything — IN 7 PARTS — Nov 2017

★ M-Systems — A Love Story and Theory of Everything — 24 Nov 2017

A More Creative Capitalism 1 — For Bill Gates — Mar 2016 to July 2018

The Susskind Boost (Ŝ) M-System 3 | 7★ | T2 T8 T10 (27 Mar 2016 - 10 Jun 2021)

The PQS — Predictive Quantum Software — 1st August 2016

M-Systems — A Digital Theory of Everything — 4 Dec 2016 to 10 Apr 2017

M-System 15 — Angel POP & The E-TOE — 18 Aug 2017

Angel Theory — Paradigm Shift — Out of Chaos — Aug to Nov 2017

Angel City 5 — The Movie — 1 Aug 2017

M-Systems Summary — MARS Resort 1 — RES — Trustees — 3 Nov 2017

M-Systems & Special Projects — A Love Story and Theory of Everything — 24 Nov 2017

Ripple Effects and Elephants for Paul G. Allen — 30 Jan 2018

A More Creative Capitalism for Bill & Melinda Gates — Summary — 24 Apr to 26 Jun 2018

A More Creative Capitalism for Bill Gates — Theoretical Physics Summary — 28 Jul 2018

A More Creative Capitalism 2 — For Bill Gates — 9 Jun to 24 Nov 2018

A More Creative Capitalism for Bill & Melinda Gates — Book — 1 Aug to 20 Oct 2018

S-World UCS Hawthorne — For Richard Thaler — 9 to 20 Jun 2018

S-World BES - Behavioural Economic Systems — 20 Jul 2018

The Rodrik Conjecture — 31 Aug 2018 to 2 Jul 2021

Chapter 4. The RES Equation — 23 Sep to 19 Oct 2018

Growth Theory - Climate Change and Charter Cities — 12 to 21 Nov 2018

Growth Theory versus Climate Change — 24 Nov 2018

Supereconomics (SuEc) — 2018 to 2020

www.SuperEconomics.Ai — Supereconomics is SuEc — 2018 to 2020

★ Angel Theory - Paradigm Shift — Summary — 2018

AT Paradigm Shift — ŔÉŚ Supereconomics — 29 May 2018

AT Paradigm Shift — A Good Model — The ŔÉŚ Equation — 10 Oct 2018

SuEc Book 3 Sixty-Four Reasons Why — Summary — Aug 2019 to Feb 2020

★ SuEc 3 Sixty-Four Reasons Why — Summary — For Kate Raworth — Feb 2020

★ SuEc Book 2 — THE HOW — Š-ŔÉŚ™ Financial Engineering — Feb 2020

SuEc Book 3 - Sixty-Four Reasons Why — 2020

SuEc Book III (09.91) — 64 Reasons Why — Complete Book — Dec 2018 to Oct 2020

SuEc Book III (10.50) — 64 Reasons Why — Summary — Sep 2019 to Mar 2020

(10.50) Summary — Part 1 — THE WHAT — S-World Angelwing Introduction

(10.50) Summary — Part 1 — THE HOW — Š-ŔÉŚ Financial Engineering

(10.50) Summary — Part 3 — A Good Model & The Feynman Sum Over Histories

(10.50) Summary — Part 4 — Internalities and Net Zero DCA

(10.50) Summary — Part 5a — Special Projects 1 to 33

(10.50) Summary — Part 5b — Special Projects 34 to 71

SuEc Book III (11.44) — 64 Reasons Why — BASIC — 24 Nov 2020 to 18 Feb 2021

S-RES Foundational Ideas — 2012 to 2016

AB 1 — Chapter 7 — Sienna’s World — S-World

AB 1 — Chapter 8 — S-World Universal Colonization Simulator — 2012

AB 2 — Chapter 1. The Entangled Butterfly — 2012

AB 2 — Chapter 3 — Strings of Life — 2012

AB 2 — Chapter 3 — Part 12. Quantum Force Theory (RES) — 2012

AB 3 — Chapter 3 — Quantum Force Theory, Spin & the RES ⇔ Equation — 2012

The Susskind Boost (Ŝ) M-System 3 — 2016

The PQS — Predictive Quantum Software — M-Systems 1 to 14 — Aug 1st 2016

A Digital Theory of Everything — M-Systems 1 to 8 — Aug 2016

M-System 10. RES — The Clinton-Trump Equation — 2016

The E-TOE Chapter 2 — The flap of A Butterfly’s Wings — Dec 13 2017

09.60__ The ŔÉŚ Equation — High-Octane Financial Engineering — Jan 2019

RES Video 25 — RES v4.14 - Manual Display - Ad Libbed — Dec 27 2022

RES Video 27) RRT and ŔÉŚ Software Design Summary — Jan 13 2019

S-RES Foundational Ideas — 2017

M-Systems - Sixteen One Page Illustrated Summaries — Jan 2017

M Systems — A Digital Theory of Everything — Apr 2017

The E-TOE Chapter 2 — The Flap of a Butterfly’s Wings — 2017

The E-TOE Chapter 3 — The Network on a String — Nov 15 2017

The E-TOE Chapter 4 — Super Coupling — Nov 19 2017

The E-TOE Chapter 5 — Quantum Time — Nov 19 2017

The E-TOE Chapter 6 — Relative Equality — Nov 19 2017

The S-World UCS™ M-Systems — 24 Nov 2017

M-Theory to M-Systems — A Love Story and Theory of Everything — Nov 24 2017

An Ecological and Philanthropic Theory of Everything plus Space — Nov 24 2017

S-WORLD

.png)

- START

-

Books 1

- S-World 2011 to 2021 — Books and Papers Index — Mid 2021

- American Butterfly (Jan 2012 to Mid 2013)

- 1. The Theory of Every Business — (Jan to Sep 2012)

- 2. Spiritually Inspired Software — (Quantum Economics) — Oct 2012

- 3. The Network on a String — (Superstring Economics) — Nov 2012 to Jan 2013

- 4. The Butterfly — Utterly Incomplete and Very Rough — Jan to Apr 2013

- MARS Resort 1 — The Return of ŔÉŚ — For Elon Musk — Oct 2017

- Ripple Effects and Elephants for Paul G Allen — Jan 2018

- The Villa Secrets Secret — 2014 to 2017

- Complete Book — PDF

- Online Version — Summary

- Chapter 1.1.6 — S-Web — Our Solution

- Chapter 2. The S-World Villa Secrets Network

- Chapter 3. Mandates - Mandates - Mandates and Prestige Marketing

- Chapter 4. The CDS — Content Distribution System

- Chapter 6. The CRM Nudge AI™

- Chapter 7. The TFS™ – Total Financial System

- Chapter 8. Villa Secrets Property Managers and Owners

- Chapter 9. S-World CRM-CC ™- The Company Controller

- Chapter 10. S-World UCS™ Hawthorne

- Angel Theory — Foundational Ideas — 2016

- A New Theory of Everything for Michael Green — March 2016

- M-System 3 — The Susskind Boost — March 2016

- M-Systems 4 — The Peet Tent — March 2016 to 2017

- M-Systems 14 — Angel Cities — May 2016

- M-Systems 1 to 14 — Aug 1st 2016

- M-Systems 1 to 8 — Aug 2016

- S-World Angel Theory — The Sienna Foundation — Inspiration — Sep 2016

- S-World — Experience Africa — Oct 2016

- S-World dot biz and American Butterfly — Nov 2016

- M-System 14 — Angel Cities and Special Projects — Nov 24th 2016

- From M-Theory to M-Systems — Dec 2016

- Angel Theory — Book — 2017 to 2021

- M-Systems & Angel City 5 — The Movie — Aug 1st 2017

- The E-TOE — The Economic Theory of Everything — Nov 2017

- A Love Story and Theory of Everything — Nov 24th 2017

- Ripple Effects and Elephants for Paul G Allen — Jan 2018

- Angel Theory — The Economic Theory of Everything — Books — Feb 2018

- Angel Theory — Paradigm Shift — April 2018

- Supereconomics Book 2 — Š-ŔÉŚ™ Financial Engineering — 2012 to Feb 2020

- Supereconomics Book 3 — 64 Reasons Why — Summary — 2019 to Feb 2020

- Supereconomics Book 2 — S-RES and The City — May 2021

- M-Systems — A More Creative Capitalism — 2016 to 2018

- Inspiration — Bill Gates Harvard Commencement Speech — 2007

- Ripple Effects and Elephants for Paul G Allen — Jan 2018

- UCS™ History 1 - POP Super Coupling — The Green Symmetry — Feb 2018

- A More Creative Capitalism — Summary — Apr 2018

- A More Create Capitalism — A Good Model — Theoretical Physics — June 2018

- A More Create Capitalism — Book — Apr to Oct 2018

- S-World UCS™ Hawthorne — For Richard Thaler & David Hoffeld — June 2018

- S-World BES™ — Behavioural Economic Systems — Malawi FC — July 2018

- The Rodrik Conjecture with Ed Witten & Stephen Hawking — Aug 2018 (& July 2021)

- A More Creative Capitalism — Chapter 4. The ŔÉŚ Equation — Oct 2018

- Growth Theory versus Climate Change (The Elephant in the Room) — Nov 24 2018

- The Momenent of Lift — A Message for Melinda French Gates — May 18 2021

- SuEc Book 2 — THE HOW — Š-ŔÉŚ™

-

Websites

- Cape Villas.com — 2000

- Experience Africa.com — 2009

- The Spartan Theory — Badly Presented but Good Ideas — 2011

- American Butterfly.org — 2012 to 2013

- Angel Theory — 2016 to 2019

- Super Economics.ai — 2020 to 2021

- S-Web™ 5.1 Websites — Part 1 — 2022

- S-Web™ 5.1 Websites — Part 2 — 2022

- For S-Web™ 5.2 Websites — See t10t.org Dropdown — 2022

- T1. S-Web.org — (Login Required) — 2022

- The 10 Technologies — (Login Required) — 2022

- Nick Ray Ball.com — 2022

-

Economics

- American Butterfly 2012 — My First Economics Book in Four Parts — 2012 to 2013

- Book 1 — The Theory of Every Business — Apr to Sep 2012

- Book 1 — Ch 7 — T5. S-World VSN — S-World — Siennas World — Aug 2012

- Book 1 — Ch 8 — T6. S-World UCS — In Game — (S-RES 1) — Sep 2012

- Book 2 — Spiritually Inspired Software — Oct to Nov 2012

- Book 2 — Ch 1 — The Entangled Butterfly (The PQS) — Oct 2012

- Book 2 — Ch 1g — Predictive Quantum Software — Oct 2012

- Book 2 — Ch 2 — To Infinity and Back Again — Nov 2012

- Book 2 — Ch 3 — Strings of Life — (S-RES 2) — Oct 2012

- Book 3 — The Network On A String — Dec 2012

- Book 3 — Ch 3 — Quantum Spin & the RES ⇔ Equation — (S-RES 3) — Dec 2012

- Book 4 — A SWOT Analysis and The Butterfly — Jan to Apr 2013

- Angel Theory — 2015 to 2017

- AngelTheory.org

- M-System 3. The Susskind Boost — Mar to May 2016

- M-System 14 — Plus the Right Side Bar Menu — 25th May 2016

- S-World Angel Theory — Inspiration — The Sienna Foundation — 9 Sep 2016

- Dr Amanda Peet — From M-Theory to M-Systems — Dec 2016 to Jan 2017

- An Introduction to M-Systems — 11 Apr 2017

- ★ M-Systems and Angel City 5 — The Movie — 1 Aug 2017

- ★ The E-TOE — An Economic Theory of Everything — IN 7 PARTS — Nov 2017

- ★ M-Systems — A Love Story and Theory of Everything — 24 Nov 2017

- A More Creative Capitalism 1 — For Bill Gates — Mar 2016 to July 2018

- The Susskind Boost (Ŝ) M-System 3 | 7★ | T2 T8 T10 (27 Mar 2016 - 10 Jun 2021)

- The PQS — Predictive Quantum Software — 1st August 2016

- M-Systems — A Digital Theory of Everything — 4 Dec 2016 to 10 Apr 2017

- M-System 15 — Angel POP & The E-TOE — 18 Aug 2017

- Angel Theory — Paradigm Shift — Out of Chaos — Aug to Nov 2017

- Angel City 5 — The Movie — 1 Aug 2017

- M-Systems Summary — MARS Resort 1 — RES — Trustees — 3 Nov 2017

- M-Systems & Special Projects — A Love Story and Theory of Everything — 24 Nov 2017

- Ripple Effects and Elephants for Paul G. Allen — 30 Jan 2018

- A More Creative Capitalism for Bill & Melinda Gates — Summary — 24 Apr to 26 Jun 2018

- A More Creative Capitalism for Bill Gates — Theoretical Physics Summary — 28 Jul 2018

- A More Creative Capitalism 2 — For Bill Gates — 9 Jun to 24 Nov 2018

- A More Creative Capitalism for Bill & Melinda Gates — Book — 1 Aug to 20 Oct 2018

- S-World UCS Hawthorne — For Richard Thaler — 9 to 20 Jun 2018

- S-World BES - Behavioural Economic Systems — 20 Jul 2018

- The Rodrik Conjecture — 31 Aug 2018 to 2 Jul 2021

- Chapter 4. The RES Equation — 23 Sep to 19 Oct 2018

- Growth Theory - Climate Change and Charter Cities — 12 to 21 Nov 2018

- Growth Theory versus Climate Change — 24 Nov 2018

- Supereconomics (SuEc) — 2018 to 2020

- www.SuperEconomics.Ai — Supereconomics is SuEc — 2018 to 2020

- ★ Angel Theory - Paradigm Shift — Summary — 2018

- AT Paradigm Shift — ŔÉŚ Supereconomics — 29 May 2018

- AT Paradigm Shift — A Good Model — The ŔÉŚ Equation — 10 Oct 2018

- SuEc Book 3 Sixty-Four Reasons Why — Summary — Aug 2019 to Feb 2020

- ★ SuEc 3 Sixty-Four Reasons Why — Summary — For Kate Raworth — Feb 2020

- ★ SuEc Book 2 — THE HOW — Š-ŔÉŚ™ Financial Engineering — Feb 2020

- SuEc Book 3 - Sixty-Four Reasons Why — 2020

- SuEc Book III (09.91) — 64 Reasons Why — Complete Book — Dec 2018 to Oct 2020

- SuEc Book III (10.50) — 64 Reasons Why — Summary — Sep 2019 to Mar 2020

- (10.50) Summary — Part 1 — THE WHAT — S-World Angelwing Introduction

- (10.50) Summary — Part 1 — THE HOW — Š-ŔÉŚ Financial Engineering

- (10.50) Summary — Part 3 — A Good Model & The Feynman Sum Over Histories

- (10.50) Summary — Part 4 — Internalities and Net Zero DCA

- (10.50) Summary — Part 5a — Special Projects 1 to 33

- (10.50) Summary — Part 5b — Special Projects 34 to 71

- SuEc Book III (11.44) — 64 Reasons Why — BASIC — 24 Nov 2020 to 18 Feb 2021

- SuEc Book 2 - Š-ŔÉŚ and The City — 27 Dec 2018 to 9 Apr 2021

- SuEc Book 2 - Š-ŔÉŚ Videos — 2019 to 2021

- SuEc Book 2 - Š-ŔÉŚ™2021—⌂≥ÉL

- SuEc Book 1. The 10 Technologies — 2022

- American Butterfly 2012 — My First Economics Book in Four Parts — 2012 to 2013

-

t10t

- T10T.org — The 10 Technologies

- T1. S-Web™ — Everything Online — Home of 60,000x

- T2. The TBS™ — Total Business Systems

- T3. Networks and Distribution — Villa Secrets Networks

- T4. S-World Film — Film | Music | PR | Behavioral Sciences

- T5. S-World VSN™ — Virtual Social Network

- T6. S-World UCS™ — Gamify the Network

- T7. Š-ŔÉŚ™2021—⌂≥ÉL — Determined (Monopoly) Economics

- T8. Net-Zero DCA Soft — Dynamic Comparative Advantage

- T9. Grand Śpin Networks — S-World Cities

- T10. 10x Our Future — S-World Angelwing Combinatorial as-if AGI

- The 10 Technologies — Advanaced

- S-World — Sienna's World — Main Presentation Website

-

T7 S-RES

- S-RES Foundational Ideas — 2012 to 2016

- AB 1 — Chapter 7 — Sienna’s World — S-World

- AB 1 — Chapter 8 — S-World Universal Colonization Simulator — 2012

- AB 2 — Chapter 1. The Entangled Butterfly — 2012

- AB 2 — Chapter 3 — Strings of Life — 2012

- AB 2 — Chapter 3 — Part 12. Quantum Force Theory (RES) — 2012

- AB 3 — Chapter 3 — Quantum Force Theory, Spin & the RES ⇔ Equation — 2012

- The Susskind Boost (Ŝ) M-System 3 — 2016

- The PQS — Predictive Quantum Software — M-Systems 1 to 14 — Aug 1st 2016

- A Digital Theory of Everything — M-Systems 1 to 8 — Aug 2016

- M-System 10. RES — The Clinton-Trump Equation — 2016

- The E-TOE Chapter 2 — The flap of A Butterfly’s Wings — Dec 13 2017

- 09.60__ The ŔÉŚ Equation — High-Octane Financial Engineering — Jan 2019

- RES Video 25 — RES v4.14 - Manual Display - Ad Libbed — Dec 27 2022

- RES Video 27) RRT and ŔÉŚ Software Design Summary — Jan 13 2019

- S-RES Foundational Ideas — 2017

- M-Systems - Sixteen One Page Illustrated Summaries — Jan 2017

- M Systems — A Digital Theory of Everything — Apr 2017

- The E-TOE Chapter 2 — The Flap of a Butterfly’s Wings — 2017

- The E-TOE Chapter 3 — The Network on a String — Nov 15 2017

- The E-TOE Chapter 4 — Super Coupling — Nov 19 2017

- The E-TOE Chapter 5 — Quantum Time — Nov 19 2017

- The E-TOE Chapter 6 — Relative Equality — Nov 19 2017

- The S-World UCS™ M-Systems — 24 Nov 2017

- M-Theory to M-Systems — A Love Story and Theory of Everything — Nov 24 2017

- An Ecological and Philanthropic Theory of Everything plus Space — Nov 24 2017

- S-RES — MARS Resort 1 - The Return of RES — 2017

- S-RES Development — 2017 to 2019

- S-RES Foundational Ideas — 2012 to 2016

-

Cape Villas™

- CapeVillas.com — Website Homepage

- Cape Villas™ — CEO Nick Ray Ball — Contact

- Cape Villas™ — Best of Cape Town — Portfolio Page

- Cape Villas™ — Best of Africa — Villas and Safaris Portfolio Page

- Cape Villas™ — Villas by World Leading Architect Stefan Antoni

- Cape Villas™ — Private-Islands

- Cape Villas™ — Cape Town Villas Near the Beach

- Supereconomics (SuEc) Book 3 Sixty-Four Reasons Why — Summary — Aug 2019 to 2020

- Cape Villas™ — 1999 to 2022